The smart Trick of Paypal Business Loan That Nobody is Discussing

Wiki Article

Paypal Business Loan for Dummies

Table of ContentsThe 7-Second Trick For Paypal Business LoanThe Best Guide To Paypal Business LoanA Biased View of Paypal Business LoanPaypal Business Loan Things To Know Before You Get ThisAll about Paypal Business LoanEverything about Paypal Business LoanPaypal Business Loan Can Be Fun For Everyone5 Simple Techniques For Paypal Business LoanThe 8-Minute Rule for Paypal Business Loan

You will certainly be representing your organization and mentioning your situation regarding why the loan provider need to consider you worthwhile of a finance. This takes some prep work on your part. You will need to have a solid service plan and a comprehensive explanation of exactly how you will utilize the cash. It also aids to consist of exactly how this money would assist you expand your organization's annual revenue.Don't neglect to clothe expertly as well as to perfect your lend a hand person and in composing, just in case they need an on the internet finance application. The huge wigs in the financial market wish to see numbers, but they are human (primarily) and can be won over by an excellent personality as well as means with words.

How Paypal Business Loan can Save You Time, Stress, and Money.

If you have a cash money flow of $5000 monthly as well as your funding repayments would be $2500, your DSCR is 2 due to the fact that your funding payment is half your revenue. Many lenders want a DSCR rating greater than 1. 5. It goes without saying, the higher your DSCR, the much better your opportunities of getting the funding.

The Best Guide To Paypal Business Loan

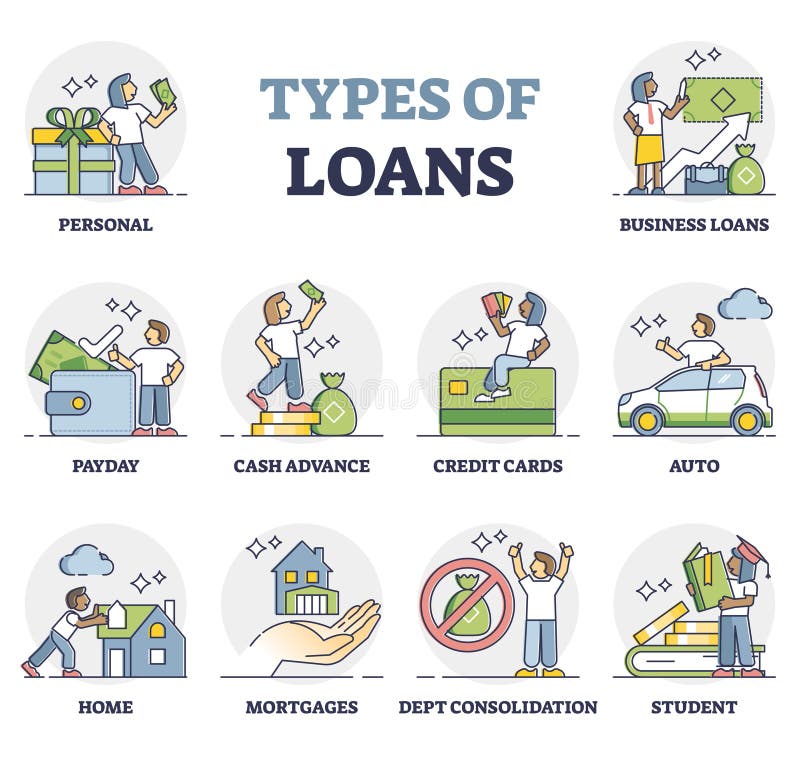

Not just does this show that you think enough in your own service to place your properties on the line, yet in some cases the organization does not have adequate security to cover the finance amount. If you want others to risk their financial resources for your service, you need to be prepared to risk your own. PayPal Business Loan.This is specifically true when you are checking out the various types of lendings readily available to you. Below are numerous of the most typical sorts of bank loan: The U.S. Small Company Administration produced this funding program to assist create even more service possibilities in the nation and, subsequently, promote a far better economic situation.

Getting My Paypal Business Loan To Work

These financings are usually secured by company assets. Recipients have the flexibility to use these funds for whatever service requires they choose. A functioning resources car loan is a short-term finance to assist business remain afloat when funding is short. These lendings can be used to pay payroll, overhead, or financial obligation.Nonetheless, you require to be mindful that you will be article anticipated to pay the financing back in full rather promptly (typically much less than 12 months). This kind of funding is comparable to an individual charge card, but it comes in the kind of a separate checking account for your company.

The smart Trick of Paypal Business Loan That Nobody is Talking About

It is very flexible but usually features a higher passion rate. When shopping around for a small company financing, there are a few various points that you should maintain your eyes and ears open for. Allow's damage down these elements of a financing and also exactly how the different kinds of financings rate for these elements.The longer you have to wait to receive your financing, the worse your financial situation can obtain. If you are in dire need of cash to maintain your service afloat, the speed of financing must be among the top concerns in your option of financing. The fastest approach of business financing is a vendor cash loan.

What Does Paypal Business Loan Mean?

As amazing of an offer as SBA financings are, this is where they drop short. SBA financings can take months to process. This can ruin a small company that requires fast financing. There's no such thing as a cost-free finance. * Nevertheless, there are some car loans that will certainly cost you less money in the long run.

The Paypal Business Loan PDFs

Big banks generally have stricter needs, making it harder to secure financing. However, they can generally provide far better rates, and you'll recognize that you are obtaining from a trusted resource. Small banks might be a official statement lot more ready to lend to services in their home town because they know the company and the organization owner.In addition to, it can be demanding to consider exactly how hard as well as extensive the settlement of these fundings can come to be. Nobody wishes to gather service financial debt. If you beware about committing to a bank loan, you do have some business financing choices that are a little easier to secure dig this (and also often extra cost-efficient).

Some Ideas on Paypal Business Loan You Need To Know

You likewise have the versatility to borrow when you require from the sanction as well as prepay when you have surplus funds. Below, you pay rate of interest only on the quantity made use of. Aside from these classifications of organization loans, we provide customised lendings to experts such as lendings for businesswomen, hired accounting professionals and also physicians. PayPal Business Loan.

The smart Trick of Paypal Business Loan That Nobody is Talking About

Small service owners normally put in a lot of influence over their company so lenders put a hefty focus on the proprietor's credit report account. The better your credit history as well as credit score (FICO), the much better the possibilities you will certainly obtain a car loan; and also, most likely on better terms.Report this wiki page